Useful features, Use ful fe atu re s – Casio SE-G1 User Manual

Page 45

E-45

Use

ful

fe

atu

re

s

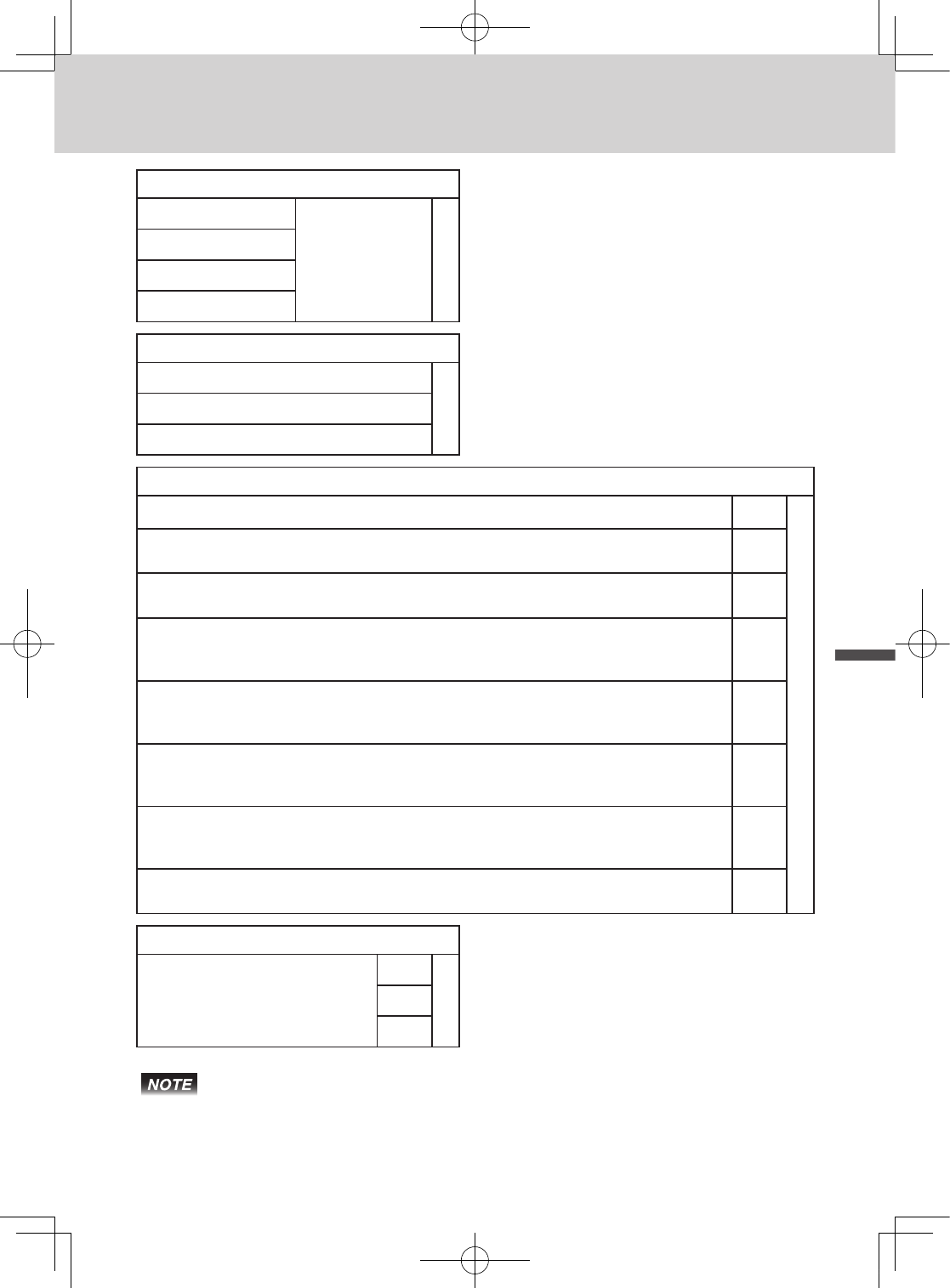

Taxable status number

Tax table 1

?ZXB

A

Tax table 2

?XXB

Tax table 3

?CXB

Tax table 4

?VXB

Rounding system

Cut off to 2 decimal places.

??

B

Round off to 2 decimal places.

B?

Round up to 2 decimal places.

>?

Special rounding specifications for subtotal and total amounts

No specifications

?

C

Special rounding 1: 0 ~ 2 60; 3 ~ 7 65; 8 ~ 9 610

Examples: 1.21=1.20; 1.26=1.25; 1.28=1.30

Z

Special rounding 2: 0 ~ 4 60; 5 ~ 9 610

Examples: 1.123=1.120; 1.525=1.530

X

Danish rounding *2: 0 ~ 24 60; 25 ~74 650; 75 ~ 100 6100

(set the amount tender restriction on page E-37 also)

Examples: 1.11=1.00; 1.39=1.50;1.99=2.00

C

Malaysian rounding: 0 ~ 2 60; 3 ~ 765; 8 ~ 9 610

(set the amount tender restriction on page E-37 also)

Examples: 1.21=1.20; 1.26=1.25; 1.28=1.30

B

Scandinavian rounding:

0~ 24 60; 25 ~ 74 650; 75 ~ 99 6100

Examples: 1.21=1.00; 1.30=1.50; 1.87=2.00

N

Australian rounding (only for tax rate 1)

0 ~ 2 60; 3 ~ 7 65; 8 ~ 9 610

Examples: 1.21=1.20; 1.26=1.25; 1.28=1.30

M

Czech/Norway rounding: 0 ~ 49 600; 50 ~ 99 6100

Examples: 1.23=1.00; 1.52=2.00

<

Add-in/Add-on

No specifications

?

D

Add-on rate tax.

X

Add-in rate tax (VAT).

C

Please see pages “To change taxable statuses of departments” on page E-46,

“To change taxable status of the percent key” on page E-47, and “To change

taxable status number of the minus key” on page E-48 for changing tax sta-

tuses on Dept. percent, and minus keys.

Useful features

SEG1_EU-e.indb 45

2012/12/07 17:18:56