Getting started, Programming tax table, Canada tax tables – Casio PCR-1000 User Manual

Page 19: Important, 5004 a, Pcr-1000 user’s manual, Must be programmed into tax table 2, 3 or 4

19

Getting Started

PCR-1000 User’s Manual

Tax table programming (continued)

Programming for Canadian Tax Tables Procedure

State sales tax calculation data tables for all of the states that make up all Canadian provinces are

included on this page. Simply find your province in the tax tables and input the data shown in its table.

Programming Tax Table

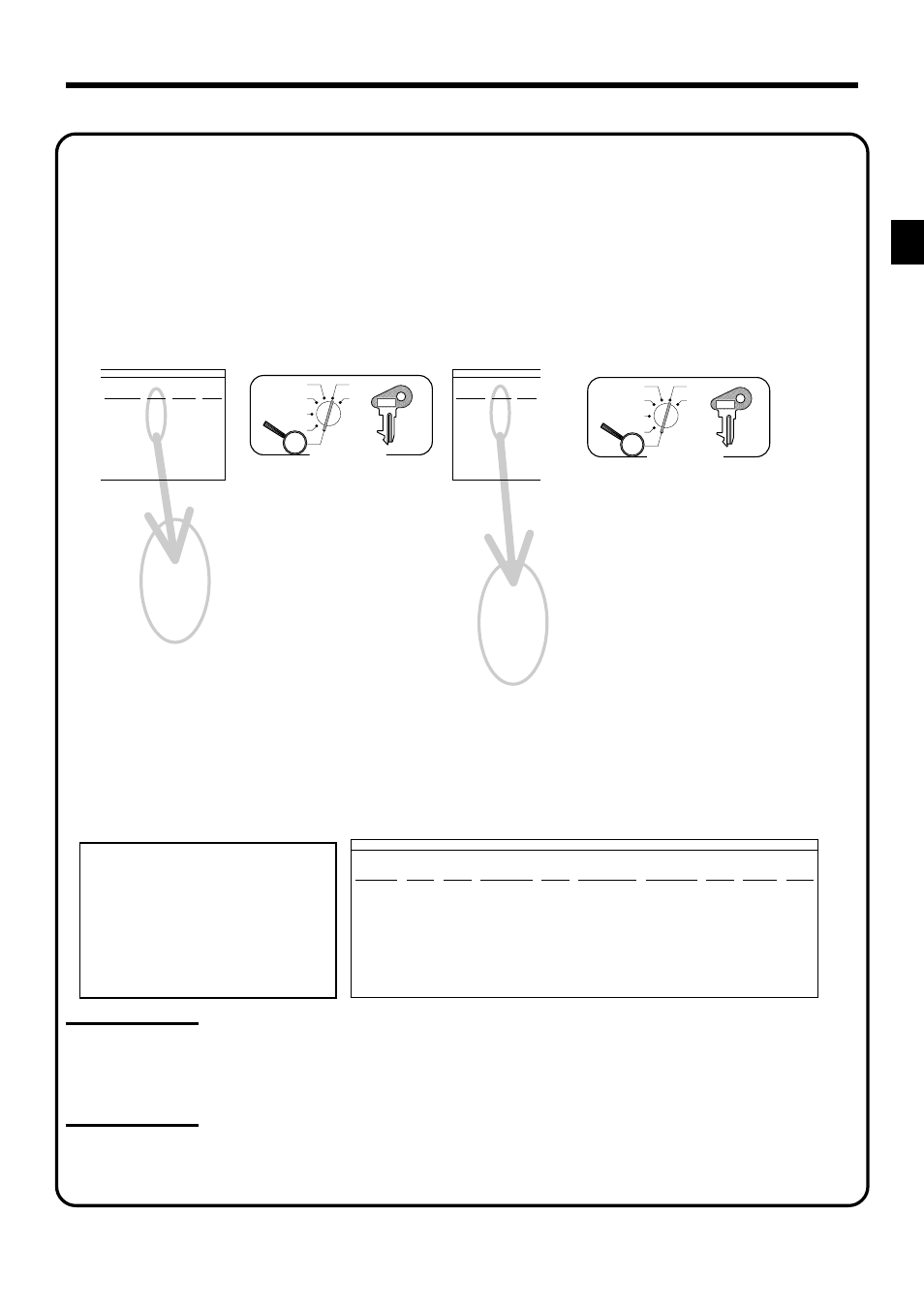

Example 1: Federal tax: 7% (Add-on/Round-off)

Example 2: Ontario 10% (Tax-on-tax/Round-off)

• 4 tax tables are used for the following purpose:

Tax table 1: Used for the federal taxable items.

Tax table 2: Used for the provincial taxable items.

Tax table 3: Used for the provincial taxable items for different tax table.

Tax table 4: Used for the provincial taxable items for different tax table.

CANADA TAX TABLES

*

Must be programmed into

Tax Table 2, 3 or 4.

Important!

Be sure you use the federal sales tax data with your provincial sales tax data. Even if your prov-

ince use the same tax rate as another province, inputting the wrong data will result incorrect tax

calculations.

Important!

Also you should select the Canadian sales tax system in the general control file (address 0422)

on page 56.

Mode Switch

X

Z

CAL

REG

OFF

RF

PGM

Mode Switch

X

Z

CAL

REG

OFF

RF

PGM

Assign Tax Table 1

7

5002

Press

a

Terminate program

2

2

2

2

2

$

3

s

$

0125

a

$

7

a

$

5002

a

$

a

$

s

Assign Tax Table 2

10

5004

Press

a

Terminate program

2

2

2

2

2

$

3

s

$

0225

a

$

10

a

$

5004

a

$

a

$

s

ONTARIO

10%

10

5004

QUEBEC

10%

10

5004

NOVA SCOTIA

10%

10

5004

6

5002

MANITOBA/

SASKATCHEWAN

6%

7

5002

ONTARIO

7%

0

1

3

25

25

31

43

56

N.B. & P.E.I.

8%

9

9002

QUEBEC

9%

(Table 3:

0325

)

(Table 4:

0425

)

P G M

C-A32

P G M

C-A32

10.

CANADA

ONTARIO

10%

10

5004

QUEBEC

10%

10

5004

NOVA SCOTIA

10%

10

5004

NEWFOUNDLAND

12%

12

5004

0

1

4

25

25

25

29

37

45

54

ONTARIO

12%

BRITISH COLUMBIA

6%

0

1

2

14

24

41

58

74

6

5002

MANITOBA/

SASKATCHEWAN

6%

7

5002

ONTARIO

7%

0

1

3

25

25

31

43

56

N.B. & P.E.I.

8%

9

9002

QUEBEC

9%

*

*

*

*

*

*

*