Gasboy CFN III Manager Manual V3.6 User Manual

Page 97

MDE-4871 CFN III Manager’s Manual for Windows® XP Embedded - Version 3.6 · August 2010

Page 10-9

How to Set Up a Tax Table

Setting Up Tax Tables

To enter an option, type a semicolon, then the option letter. To enter an argument, type a space,

then a dash, then the argument character. Options and arguments for TAX are not

case-sensitive. That means you may type them in upper case or lower case. They are shown

below in upper case.

If you specify an option not on this list, TAX will print Invalid option and quit. If you specify

an argument not on this list, it will print a list of valid options and arguments, then quit.

When you are ready to build your tax table, use the TAX program. The following paragraphs

list the prompts that TAX displays and explains how to respond to them.

Tax number, P, P#, T, T#, or Q to quit?

• Enter a tax number to create or edit a table for that tax code number (remember that you

must already have assigned, with the LOAD TAX command, the number you enter to

create a new table). If you enter a tax number, the next prompt appears.

• Enter P to print a summary of all taxes whose names have been loaded with LOAD TAX.

The summary is the same report that prints if you use the -P argument with the TAX

program.

• Enter P# to print a summary of the specified tax (specify the tax’s number in place of the #

sign).

• Enter T to print a tax table. Then, in response to the next prompt, enter the number of the

table you want to print. You can compare this printout with the tax table you obtained from

the taxing authorities or a bank to verify that the tax has been entered correctly.

• Enter T# to print a table of the specified tax (specify the table’s number in place of the #

sign).

• To exit the program, enter Q or press RETURN.

Tax type, Q to quit, RETURN for same?

• Enter 0, 1, or 2 to specify the tax type for the tax number you entered. The default is zero.

• 0 (zero) indicates a tax rate with rounding. If the tax number you specified had been

defined as a type 1 or 2, entering a zero here redefines it as a type 0. For taxes of type 0,

TAX does not do anything other than set tax type and table maximum.

• 1 (one) indicates a table created through a compressed description (as explained in this

chapter). The program continues the prompts through Smallest taxable amount (cents)?

Then it begins at the point where it was when you last entered data for the table. You can

add commands to the end of the table or delete commands from the end of the table.

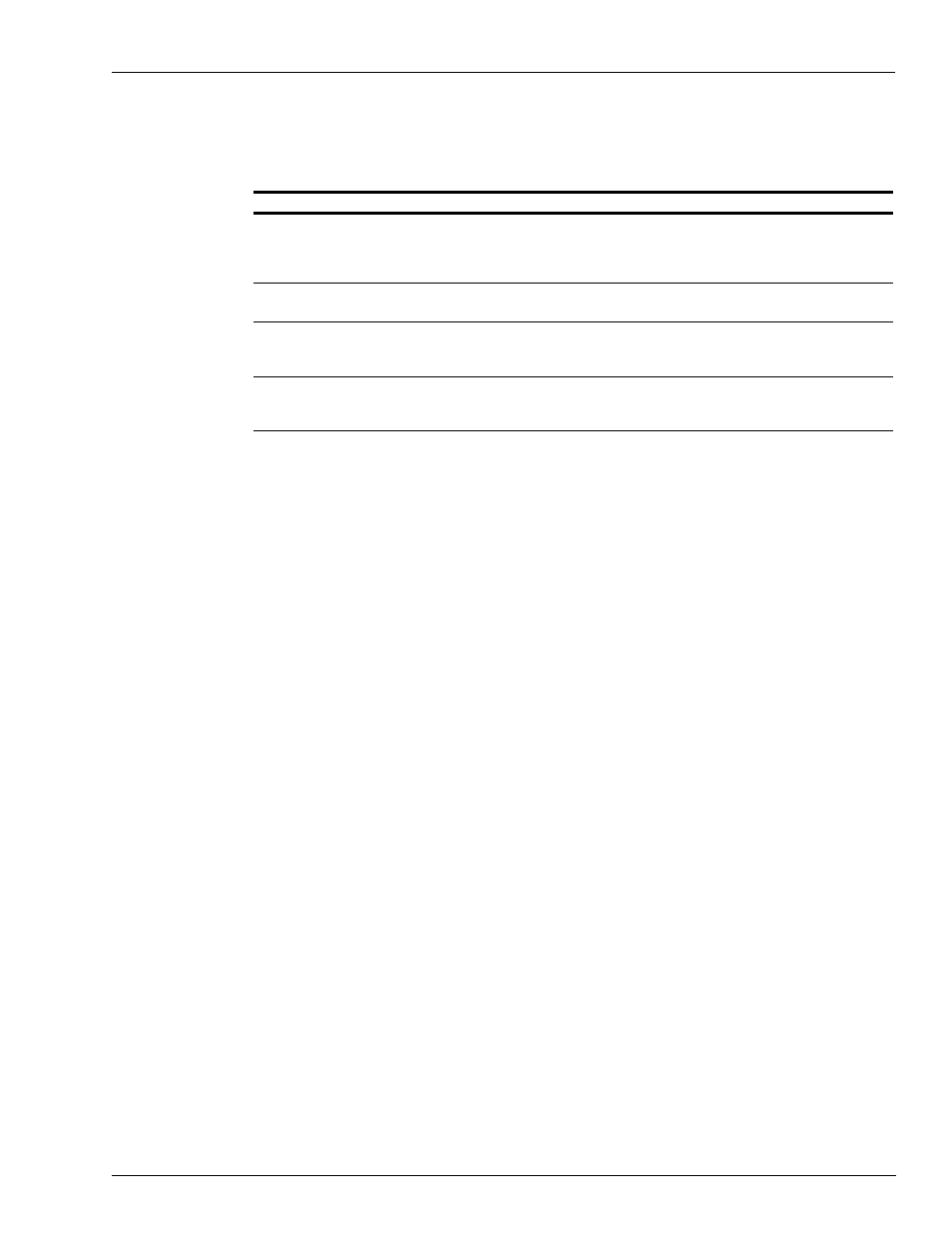

Option

Effect

;I

CAUTION: Do not use this option after you have entered tax information you want to save. It initializes

the tax tables-that is, it erases all the tax information. All taxes become type 0 (rate tables rather than

lookup tables), but tax numbers and names remain unchanged. The program prompts you to confirm

that you want to initialize, then it erases the tax information and quits.

-P

Used with this argument, TAX prints a summary of all taxes whose names have been loaded with LOAD

TAX.

-R

Used with this argument, TAX prints all information from the tax rate table in a raw form suitable for the

RESTORE command to use in restoring the tax table. The standard command file SYSBACK calls TAX

with this argument. Normally, you will not use this argument.

-?

Used with this argument, TAX runs in tutorial mode. When any prompt is displayed for the first time, it is

preceded by its help message. You can print the help message again by entering a question mark (?) in

response to the prompt when it appears again. This mode is useful if you have not run TAX many times.